Conference Poster Presentations

How Are Emotions Related to Everyday Spending? An Experience Sampling Study.

Presented at Society for Affective Sciences (SAS) 2018 at UCLA.

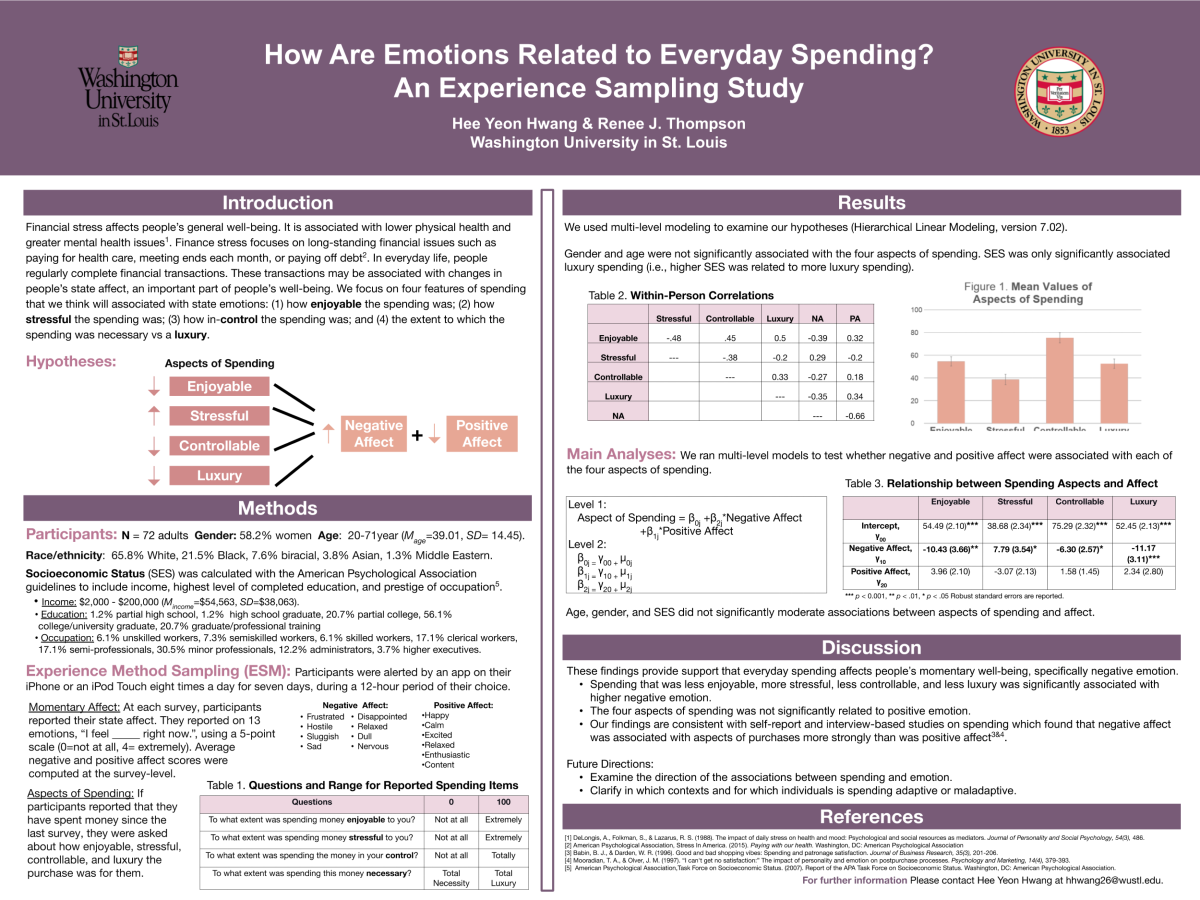

Higher financial stress is related to lower physical health and higher psychological distress, highlighting how financial stress affects general well-being. In the present study, we examine how everyday spending is associated with state emotion to elucidate how this aspect of people’s finances affects well-being at a momentary level. Seventy-nine adults recruited from the community completed experience sampling surveys eight times a day for a week. At each survey, participants reported their momentary emotion, and when participants endorsed spending money, they reported the extent to which the spending was enjoyable, stressful, necessary, and in their control.

Using multi-level modeling, we examined how negative and positive emotion (entered simultaneously) predicted each of the four aspects of spending. Spending that was less enjoyable, more stressful, more necessary, and less in people’s control was significantly associated with higher negative emotion, ts(395)>2.69, but not positive emotion, ts(395) < 1.75. These findings held after taking into account participants’ age, gender, and socioeconomic status.

These results highlight how everyday spending affects people’s momentary well-being, demonstrating specificity to negative emotion. Future research should examine the direction of the associations between spending and emotion to test, for example, whether people are spending money to regulate their emotion. Finally, spending is not inherently good or bad; instead, research is needed to clarify in which contexts and for which individuals is spending adaptive or maladaptive.

Emotion Regulation Strategy Self-Efficacy Beliefs Predict Habitual Strategy Use.

Presented at the Emotion Preconference at Society for Personality and Social Sciences (SPSP) 2017 in San Antonio, TX.

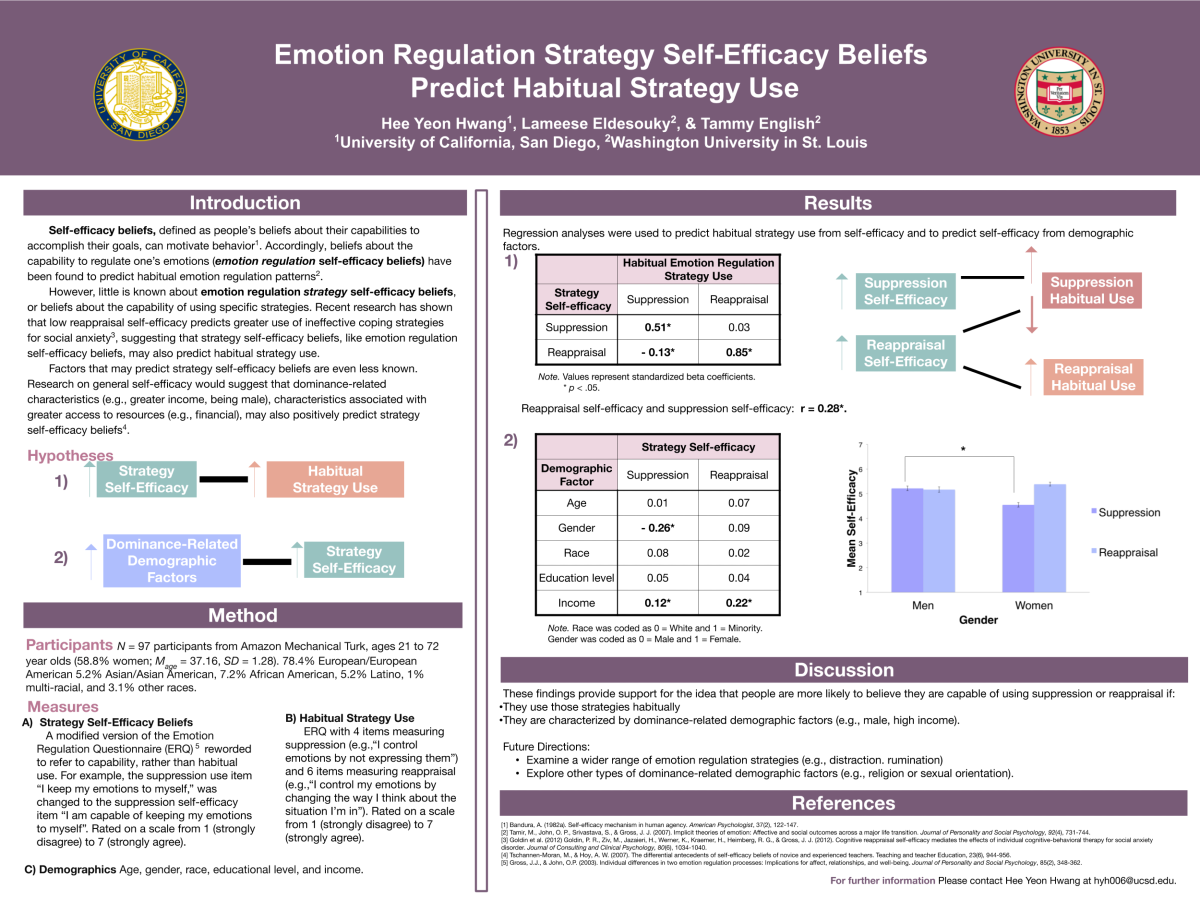

Self-efficacy beliefs are important for motivating several behaviors, such as self-regulation and coping. However, little is known about how emotion regulation self-efficacy beliefs predict strategy use, or what factors predict these beliefs. In the current study, we examined how self-efficacy beliefs of two commonly used strategies – suppression and reappraisal – predict habitual strategy use. We also examined how demographic factors might predict strategy self-efficacy beliefs.

Participants (n = 97, ages 21-72) completed survey measures of habitual strategy use, strategy self-efficacy beliefs, and demographics. Higher suppression self-efficacy predicted greater suppression use. Meanwhile, higher reappraisal self-efficacy predicted greater reappraisal and lower suppression use. In terms of factors predicting beliefs, people with higher income thought they were more capable of suppressing and reappraising their emotions, and men thought they were more capable of suppressing their emotions than women. Age, race, and educational levels did not predict self-efficacy beliefs.

These findings suggest that certain dominance-related demographic factors are linked to greater self-efficacy, at least for certain strategies. The links between self-efficacy and strategy use suggests self-efficacy may increase use of strategies. Or, alternatively, frequently using a strategy might increase one’s confidence in using it.